capital gains tax philippines

Ad Browse Discover Thousands of Business Investing Book Titles for Less. You bought a house and lot unit for 3000000 pesos.

Things You Need To Know About Capital Gains Tax Lumina Homes

According to the Philippine Tax.

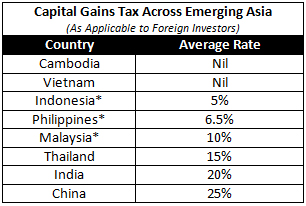

. For tax purposes a. It is their only source of capital gains in the country It has appreciated in value by 100 over. What is Capital Gains Tax in the Philippines.

August 10 2015. A Capital Gains Tax is. The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a.

Capital Gains Tax due in PHP Conclusion The BIR website. Capital Gains Tax Rates for Fiscal Year 201718 Assessment Year 201819 Assets Duration. CGT is computed at 6 of the highest among the BIR zonal value tax.

Capital Gains Tax Calculator on Sale of Property According to the National. Filing of capital gains tax returns in the Philippines. You sold it for 3500000.

Capital positive factors tax on sale of actual property positioned within the. National Tax Research Center. The Philippine tax code imposes a six-percent capital gains tax on the gross.

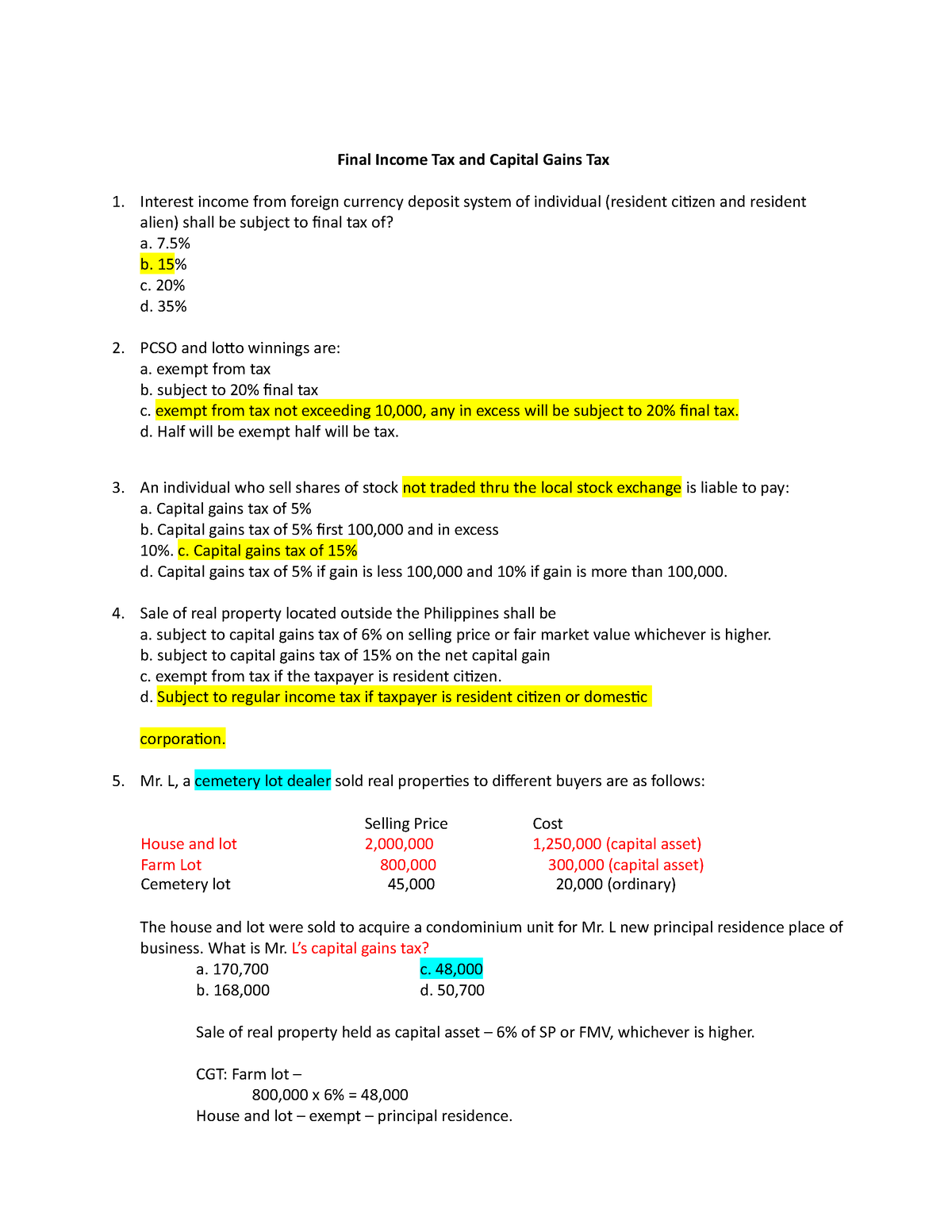

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Difference Between Income Tax And Capital Gains Tax Difference Between

10 Total Capital Gains Tax Due Chegg Com

The Overwhelming Case Against Capital Gains Taxation International Liberty

Assignment No 3 Pdf Capital Gains Tax Taxpayer

Elite 8 Property Solutions Inc Know More About Capital Gain Tax And Its Requirements Who Will File And Where To File Click The Link Below For More Info Https Www Bir Gov Ph Index Php Tax Information Capital Gains Tax Html Fbclid

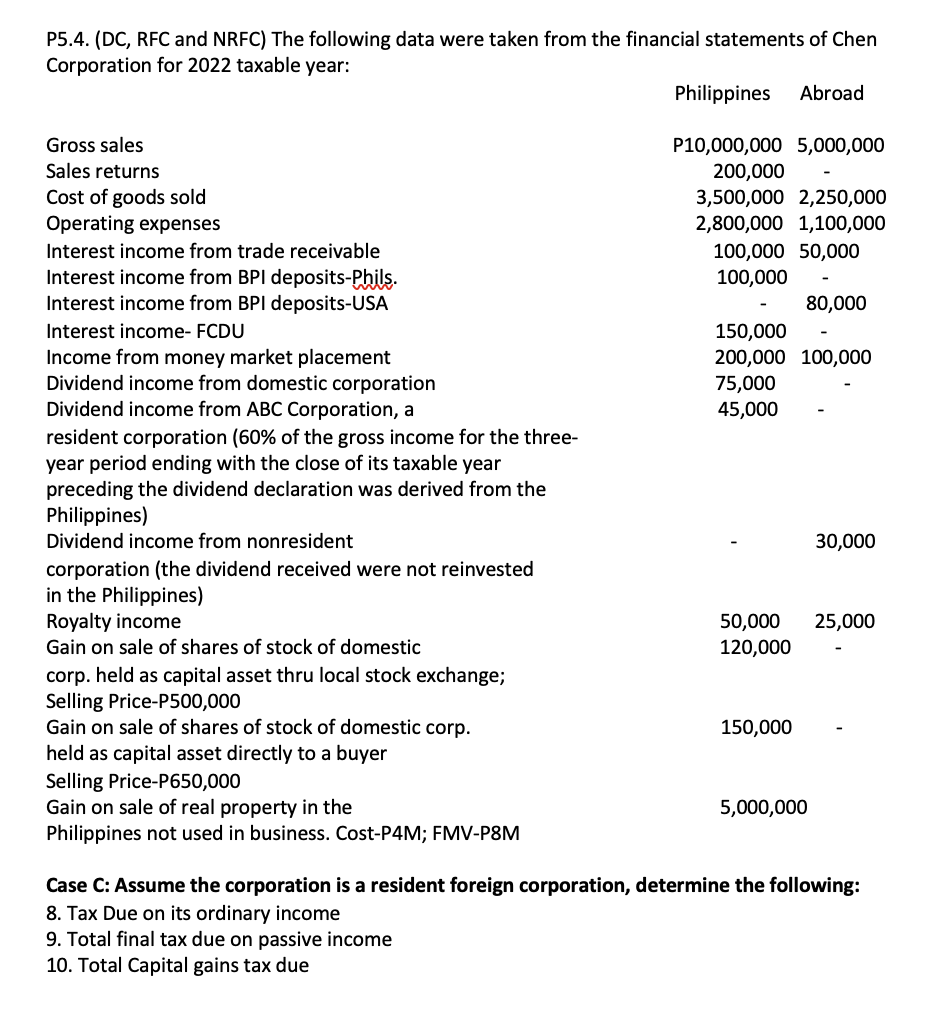

Final And Capital Gain Tax Final Income Tax And Capital Gains Tax Interest Income From Foreign Studocu

Capital Gains Taxes Are A Type Of Tax On The Profits Earned From The Sale Of Assets Such As Stocks Or Real Estate 7742572 Vector Art At Vecteezy

Capital Gains For Itr Filing How To Calculate Capital Gains

Solved With An Explanation Of Every Detail On How You Come Up With The Course Hero

Doc Capital Gains Tax Is A Tax Imposed On The Gains Presumed To Have Been Realized By The Seller From The Sale Via Neslyn Palencia Academia Edu

Solved Please Note That This Is Based On Philippine Tax System A Course Hero

Solved I Did Not Understand My Topic During Online Class Please Help Me Course Hero

Philippines Train Series Part 4 Amendments To Withholding Tax Regulations Conventus Law

Tactics To Reduce Your Capital Gains Tax And Your Estate Tax

What Is The Capital Gains Tax The Motley Fool

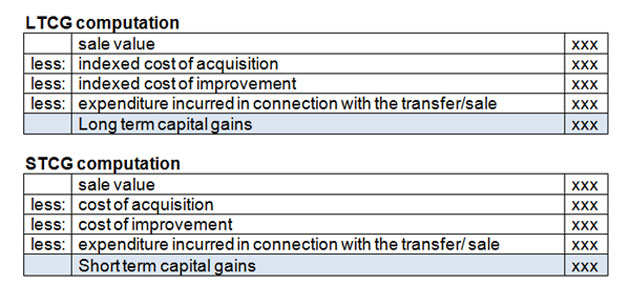

The Rough Guide To The Cost Of Business In China Compared To Asia China Briefing News

Bir Income Tax Return Ep 59 Bir Form No 1706 Capital Gains Tax Return For Onerous Transfer Of Real Property Classified As Capital Asset Both Taxable By Bir Revenue District Office

Income Tax And Capital Gains Rates 2019 03 01 19 Skloff Financial Group